In the specialized field of probate, compliance is the foundation of efficiency. For attorneys managing filings across Ohio’s county probate courts, the stakes are high: a single error, a missed deadline, or an outdated probate form can lead to rejection, costly re-work, and damaged client trust.

The solution is not just better organization; it is a systemic process to mitigate administrative risk. While no checklist can replace legal judgment, a robust compliance framework is essential to stop the silent financial and professional drain caused by manual mistakes.

The Cost of Administrative Non-Compliance

In Ohio probate practice, adherence to rules is non-negotiable. However, relying on traditional methods like static legal document templates or internal spreadsheets makes compliance a high-risk manual task.

The Two Major Administrative Costs:

- Lost Time and Re-work: Every filing rejection triggers an immediate loss of billable time. The process requires a paralegal to find the error, revise the document, and resubmit, often taking non-billable hours per incident.

- The Obsolete Form Trap: Ohio forms are governed by both the statewide Supreme Court rules and various local county rules. When a rule changes, a manually stored template used by an attorney or paralegal becomes obsolete, placing the firm at risk of filing the wrong document entirely.

The compliance objective must be integrated into the workflow, not just checked at the end.

Three Pillars of the Ohio Probate Compliance Checklist

A truly robust compliance framework must be broken down into these three non-negotiable stages.

1. Mandatory Data Verification

This pillar ensures the system has collected every critical piece of information required for the initial filing.

| Checklist Component | Rationale for Compliance | Risk of Failure |

| Executor/Admin Data | Full Name, Address, County, and Attorney Registration Number must be present. | Clerk’s office will reject the initial filing immediately if the attorney’s info is incorrect or missing. |

| Decedent & Venue | Date of Death and proper County of Residence for venue verification. | Incorrect venue or jurisdiction will force the case to be reopened in the correct county. |

| Asset & Heir Lists | Requires full, verifiable names and addresses for all heirs and a comprehensive, accurate asset inventory. | Leads to future challenges, disputes, and extended closing timelines. |

2. Current Form Integrity

This is the most time-consuming step for manual processes and the most critical area where automated probate software for attorneys provides value.

A manual checklist must confirm the current form number and date:

- Supreme Court Standardized Forms: Verify that the form used matches the latest version available on the Supreme Court’s official site.

- Mandatory Local Forms: Confirm the local county court (e.g., Franklin County or Cuyahoga County) does not require a local variance form or a supplemental filing not covered by the statewide forms.

- Template Retirement: Immediately retire any old, unverified legal document templates stored locally.

3. Procedural Timeline & Checklist Management

Compliance also hinges on the timing of your actions, not just the forms themselves.

- Initial Filing (Will): Was the will filed within the expected time after death?

- Notice: Was notice given to the beneficiaries and interested parties within the required statutory timeframe?

- Inventory Filing: Was the inventory filed within the mandated three-month period?

The Only Sustainable Solution: Automation

Attempting to manage the complexities of probate forms Ohio using a static checklist is simply unsustainable and defeats the purpose of efficiency. The human time required for constant cross-referencing and verification eats deeply into profit margin.

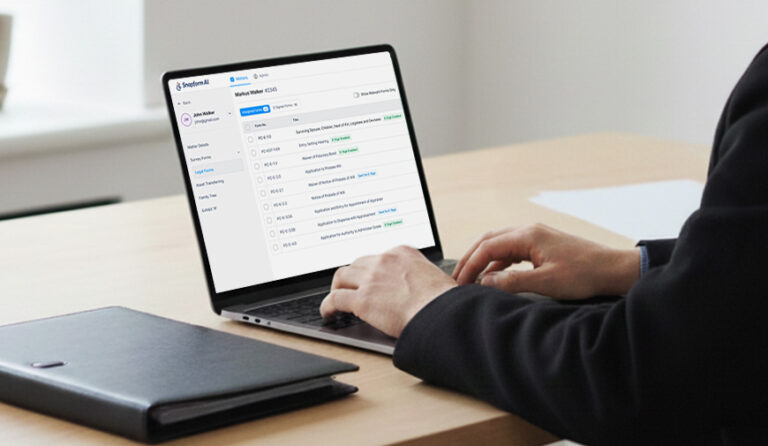

This is why specialized probate software for attorneys is the single best investment your firm can make in efficiency.

- Zero-Risk Automation: The software manages the checklist for you. It automatically generates the correct, court-ready probate forms Ohio using data verified against the current rule sets.

- Parallel Workflows: By verifying data in real-time as the client enters it, the system ensures compliance from the very first minute, preventing errors before they can happen.

Conclusion: Transform Compliance from Risk to Advantage

Compliance should not be a manual burden; it should be an administrative guarantee. By adopting specialized probate software for attorneys, you move beyond the reactive process of checking manual lists and adopt a proactive system that guarantees the integrity of every filing.

Snapform AI provides the foundation for this transformation. Our specialized platform turns the complexity of probate forms Ohio into the efficiency your firm needs to grow.

Ready to secure your compliance and stop losing time to costly rejections?

Book a quick demo today to see how zero-error automation works.

Frequently Asked Questions (FAQ)

The primary cause is administrative non-compliance, such as using an outdated version of a probate form, incorrect attorney registration numbers, or missing mandatory data fields. The failure is typically a procedural one, not a legal one.

You can, but it is high-risk. Generic legal document templates do not track changes to local court rules, forcing the firm to manually assume the liability of ensuring compliance for every submission.

The most reliable method is using a specialized platform (like Snapform AI) that guarantees its form library is instantly updated according to state and local judicial rules, removing the administrative burden from the firm.

The financial risk is tied to lost productivity. Every rejected filing requires non-billable staff time for rework and creates delays that negatively impact client trust.